Get paid by robots

Article Navigation

Why automation in payroll is here to stay

- Does the fact that a payroll outsourcing provider employs thousands of payroll specialists across a number of countries signify the success of the payroll outsourcing industry?

- Is having thousands of payroll specialists on board indicative of payroll outsourcing providers’ might and capability?

Surprisingly, a number of these payroll industry leaders and analysts talk about these numbers as if it were a success metric. It is not.

Having thousands of payroll specialists on board is neither sustainable nor scalable.

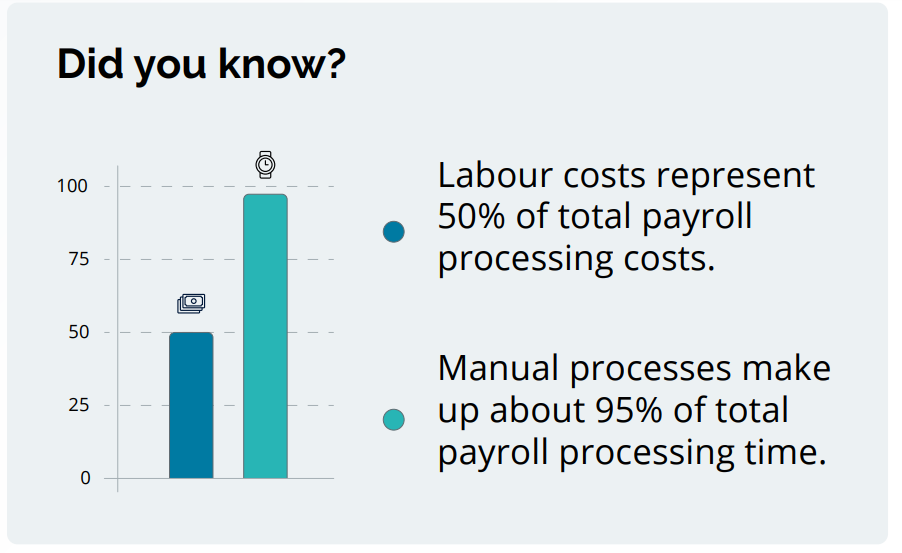

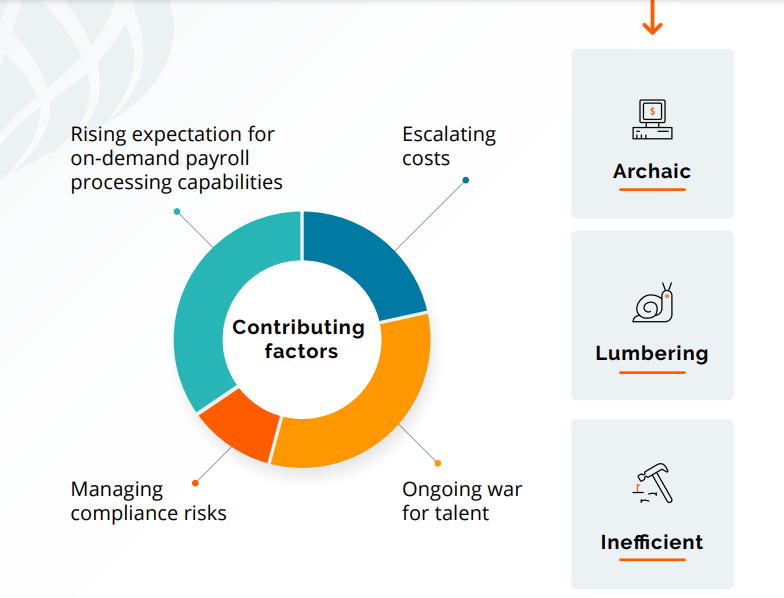

Huge payroll processing centres are

At Mercans, we believe that it’s time for the machines to replace humans when it comes to payroll processing.

But how?

Is it possible for robots to decide WHO and HOW much to pay?

YES

Automation in payroll is here to stay. What is the current reality?

Many payroll processes have already begun undergoing some degree of automation. These have brought significant relief for many payroll specialists.

But the adoption of automation in payroll is still far too low.

Can Artificial Intelligence (AI) and Machine Learning (ML) really change how people get paid?

Yes, they can.

Humans will always make decisions about how much an individual should be paid.

Making sure that you’re:

- paid correctly

- paid on time

- paid in the currency desired

Mercans’ solutions can already

- analyze and recognize the patterns in payroll inputs and outputs

- detect abnormalities

- identify items that require further audit

Mercans leverages ML to analyze

WHY?

to identify patterns that could be indicators for potential fraud or repetitive issues

The same algorithm is also used to compare employee attendance data with payroll calculations to identify inconsistencies and potential overpayments.

What tangible results are already available when ML use is combined with payroll robotics?

- Detect no-change payrolls and generate payroll reports without human intervention

- Detect fraud and employee abuse by analyzing workforce management and attendance data

- Audit payrolls by analyzing payroll inputs and outputs, identify patterns and possible deviations

- Analyze payroll outputs and detect inconsistencies

Adopt HR Blizz ™

enable payroll generation with zero human intervention

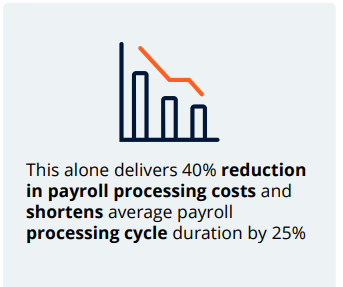

ML-based payroll audit functionality that creates time and cost savings by significantly reducing payroll audit effort

ML tool to detect attendance-related fraud and waste

powerful tool that enables end-to-end payroll process automation by combining ML and robotics

Conclusion

At Mercans, we believe that robots can and should manage payroll while humans enjoy the benefits of getting paid.

Say goodbye to massive payroll processing centers and let’s make payroll a career choice for the machines.

Contact Sales

![]() +1 877 637 2267

+1 877 637 2267