Article Navigation

Introduction

In the era of data-driven decision-making, businesses across all industries are recognizing the immense value of analytics. Payroll data analytics, in particular, offers a wealth of insights that can revolutionize the way payroll companies operate. By harnessing the power of data, these companies can enhance efficiency, optimize processes, mitigate risks, and ultimately provide better services to their clients. In this blog post, we will explore the significance of payroll data analytics and discuss how payroll companies can leverage it to drive success.

Understanding Payroll Data Analytics

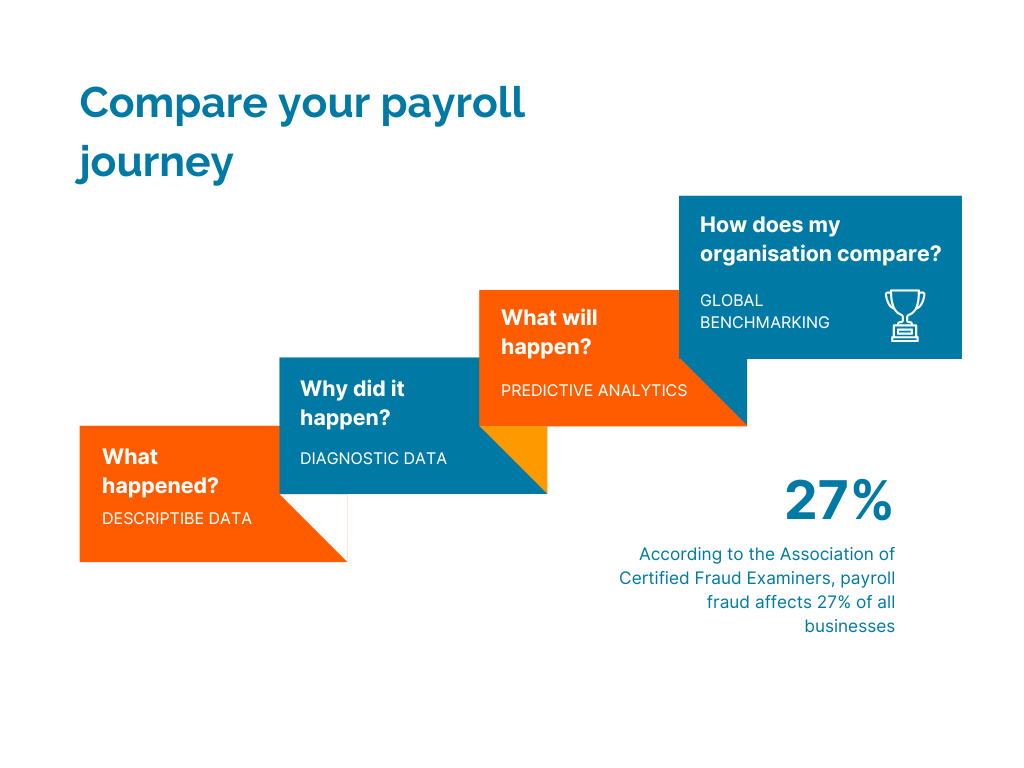

Payroll data analytics refers to the practice of gathering, organizing, and analyzing payroll-related data to extract meaningful insights. This data encompasses various aspects of employee compensation, such as salary, bonuses, deductions, benefits, and tax information. By employing advanced analytical techniques, payroll companies can gain a comprehensive understanding of their clients’ payroll processes, identify patterns, and make informed decisions.

Leveraging Payroll Data Analytics

Mercans, a leading payroll company, recognizes the immense value of payroll data analytics and effectively leverages it to optimize their operations and provide exceptional services to their clients. Here’s how Mercans utilizes payroll data analytics:

Process Optimization

Mercans uses payroll data analytics to identify areas within the payroll process that can be streamlined and improved. By analyzing data points such as payroll cycle time, error rates, and discrepancies, they can identify bottlenecks, automate manual tasks, and enhance overall efficiency. This results in faster and more accurate payroll processing, saving both Mercans and their clients time and resources.

Compliance and Risk Management

Mercans understands the importance of compliance with local labor laws, tax regulations, and data protection requirements. Through payroll data analytics, they monitor and analyze payroll data to ensure adherence to legal and regulatory obligations. By identifying any potential non-compliance issues or risks, Mercans can take proactive measures to rectify them, minimizing the likelihood of penalties or legal consequences for their clients.

Predictive Analytics for Workforce Planning

Leveraging payroll data analytics, Mercans provides clients with valuable insights into workforce patterns and trends. By analyzing historical data, they can forecast future staffing needs, identify skill gaps, and assist clients in optimizing their workforce planning strategies. This helps clients ensure that they have the right talent in place to meet business demands and avoid any workforce shortages or excesses.

Employee Engagement and Retention

Mercans recognizes that employee satisfaction and retention are critical for their clients’ success. By analyzing payroll data related to compensation, benefits, and performance, Mercans helps identify factors that impact employee engagement and retention rates. They can provide data-driven insights and recommendations to clients, enabling them to design effective retention strategies, improve compensation structures, and enhance overall employee satisfaction.

Actionable Reporting and Business Intelligence

Mercans utilizes payroll data analytics to generate comprehensive reports and provide valuable business intelligence to their clients. By aggregating and analyzing data from multiple clients, they offer benchmarking insights, highlight areas for improvement, and provide customized reports tailored to meet clients’ specific needs. This helps clients gain a deeper understanding of their payroll operations and make informed decisions to drive their business forward.

Final Thoughts

Payroll data analytics presents a vast array of opportunities for payroll companies to optimize their operations and deliver superior services to their clients. By leveraging data-driven insights, these companies can streamline processes, ensure compliance, make informed workforce planning decisions, enhance employee engagement, and provide valuable business intelligence to their clients. As the world becomes increasingly data-centric, payroll companies that embrace the power of analytics will gain a competitive edge and position themselves as trusted partners in their clients’ success.

Payroll data analytics is allowing companies to unlock the potential of the data they have had all along. Through conducting thorough analysis of payroll data, businesses can extract valuable insights that can be leveraged to create outstanding customer and employee experiences and achieve superior business results.