The new era of expat payroll

Article Navigation

Did you ever notice?

Why managing payroll for expatriate employees has been a significant challenge for global mobility and payroll specialists.

Out of all the zillion challenges a payroll specialist face, these are the critical ones

- keeping track of ever-changing exchange rates

- understanding the distinction between home country and host country payouts

- developing clarity about how taxes are calculated in different countries

- managing gross-up & hypo tax calculations

What is hypo tax?

It is short for hypothetical tax which can occur when employees work on international assignments and are seconded to another tax jurisdiction for a finite period.

What is gross-up?

It refers to the additional money an employer pays an employee to offset any additional income taxes that need to be withheld from payment.

The complexities that surround these challenges have created a whole industry of global mobility and tax specialists who address these challenges and reap the benefits through massive fees.

The world of expat payroll continues to be shrouded in mystery that no one wants to question until now.

So why has expat payroll remained complicated and expensive?

The answer is simple.

1) Significantly complex calculations

Running payroll calculations in the context of a single country is straightforward.

However, generating simultaneous payrolls in two jurisdictions and then reconciling and consolidating these calculations in different currencies is not easy.

It requires extensive manual labour to track, reconcile and manage.

2) Epic taxation expertise

Payroll specialists need to ensure that employees are neither underpaid nor overpaid, especially since these calculations involve gross-ups, hypo taxes as well as home and host country draws.

In fact, the process is equivalent to consolidating the financial results of two companies.

How has Mercans been able to automate expat payroll calculations and slash its costs while other payroll providers charge exorbitant fees for expat payroll?

The solution is straightforward

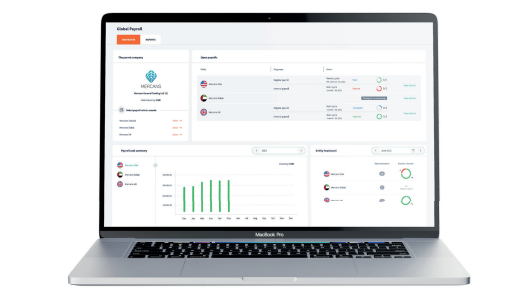

Mercans’ HR Blizz TM is a global payroll suite which enables native tax calculations for 160 countries across the globe.

This means that when a client sends an employee from one country to another, that employee’s payroll calculations will be processed on HR Blizz in both countries.

We then convert the calculations to a single currency, apply the tax rules of the host and home country, process automatic gross-up calculations and consolidate the results of these calculations. All of which happens in nanoseconds. Automatically.

This is the new era of expat payroll where massive fees for global mobility and expat tax advisory are history.

Welcome to HR Blizz TM

Welcome to a world of global payroll automation and speed.