Payroll Technology is the Future of Payroll:

Article Navigation

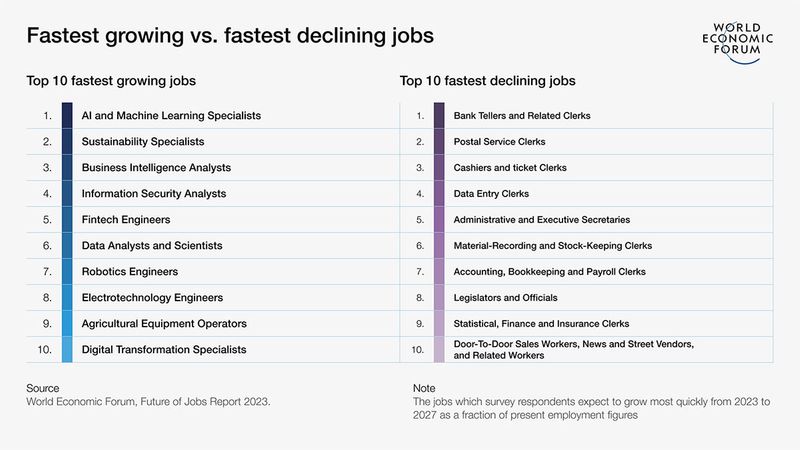

According to a recent report by World Economic Forum, payroll clerks are one of the top 10 fastest-declining jobs in 2023. This news may come as a surprise to many individuals who have dedicated their careers to the field of payroll. However, the emergence of payroll technology is changing the landscape of the industry, creating both challenges and opportunities for those in the field.

Payroll technology has the potential to streamline payroll processes and reduce manual labor. By automating payroll tasks such as time tracking, data entry, and tax calculations, companies can reduce costs and improve accuracy. This can create a more efficient and effective payroll system for both the company and the employees.

But what does this mean for payroll clerks? As payroll technology continues to advance, some tasks that were once performed by payroll clerks may become automated. This could lead to a decline in job opportunities for those who are solely focused on manual payroll processes.

However, this doesn’t mean that payroll clerks are out of a job. In fact, with the emergence of payroll technology, there are new opportunities for payroll clerks to upskill themselves and embrace the changing industry. By learning about the latest payroll technology trends, payroll clerks can position themselves as valuable assets to their organizations.

5 additional points on how employees can upskill themselves with payroll technology:

- Attend training sessions: Many payroll technology providers offer training sessions and webinars to help users become more proficient in using their software. Attending these sessions can help payroll clerks become more comfortable with the software and learn about new features and updates.

- Join professional organizations: Joining professional organizations such as the American Payroll Association or the Chartered Institute of Payroll Professionals can help payroll clerks stay up-to-date with the latest industry trends and connect with other payroll professionals.

- Pursue certifications: Certifications such as the Certified Payroll Professional (CPP) or the Fundamental Payroll Certification (FPC) can help payroll clerks demonstrate their expertise in the field and make them more marketable to potential employers.

- Learn about compliance: With the ever-changing landscape of payroll compliance, it’s important for payroll clerks to stay up-to-date with the latest regulations and laws. This can help companies avoid costly penalties and fines.

- Take on additional responsibilities: Payroll clerks who are willing to take on additional responsibilities outside of their normal job duties can demonstrate their value to their organizations. This can include tasks such as managing employee benefits or overseeing HR compliance. By expanding their skill set, payroll clerks can make themselves indispensable to their organizations.

Conclusion

In conclusion, the future of payroll is payroll technology. While this may be a cause for concern for some payroll clerks, it’s important to recognize that there are new opportunities for those who are willing to upskill themselves and embrace the changing industry. By becoming experts in payroll technology and data analysis, payroll clerks can position themselves as valuable assets to their organizations and create new career paths for themselves.

Source

World Economic Forum | Future of Jobs Report 2023