Article Navigation

- Ensuring that the worker’s employment adheres to the country’s legal framework.

- Managing the local payroll process efficiently.

- Handling the filing of employment-related taxes and all necessary paperwork.

- Providing workers with accurate payslips.

- Disbursing workers’ salary payments promptly.

Simplify your global expansion with our Global PEO services – a hassle-free solution without the need for entity setup. Our Employer of Record (EOR) in the Middle East, particularly in the UAE, assures legal compliance, a solid legal presence, and Intellectual Property protection, allowing your business to focus on its core operations. Facilitate seamless global mobility and work visas while building a diverse and efficient global workforce. Partner with Mercans, your trusted Employer of Record in the UAE, to ensure a compliant and efficient employment experience for your global workforce.

Roles and responsibilities of Employer of Record in UAE

Background Verification

The Employer of Record UAE conducts thorough background checks to ensure the suitability of employees for specific roles.

Employee Onboarding

Streamlining the process of integrating new employees into the company, ensuring a smooth transition and legal compliance.

Payments

Managing timely and accurate disbursement of salaries and benefits to employees, adhering to local regulations.

Local Labor Laws Compliance

Ensuring that the organization and its employees adhere to the labor laws and regulations of the UAE.

IP Protection

Safeguarding intellectual property rights and ensuring legal protection for the company’s assets.

Payroll Management

Handling the intricacies of payroll processing, tax compliance, and ensuring the accuracy of employee compensation.

Employer of Record Dubai

Mercans, as an Employer of Record (EOR) in Dubai, extends its expertise to assist foreign companies with comprehensive EOR services. With a dedicated entity in Dubai, Mercans ensures smooth market entry, legal compliance, and seamless HR and payroll solutions for international businesses.

Things you need to know before hiring in UAE

Hiring employees in the UAE involves specific legal and regulatory requirements, particularly when dealing with expatriates. To navigate this process effectively, companies must establish a legal entity, sponsor employee work visas, understand unique compensation structures, adapt to the local workweek, and account for the End of Service Gratuity. The UAE encourages foreign investment and foreign workers but imposes strict employment laws. Employers must provide documented job offers, comply with labor regulations, and ensure clear communication with employees. Obtaining necessary documents, understanding the offer, and adhering to employment contracts are essential aspects of the hiring process in the UAE.

In such cases, an Employer of Record UAE can help organizations simplify many operations.

Employees vs Independent Contractor Compliance

| Aspect | Employees | Independent Contractors |

|---|---|---|

| Legal Framework | Governed by UAE Labour Law (Federal Decree Law No. 33 of 2021). | Typically operate outside Labour Law. |

| Hiring Process | Requires a written employment contract in compliance with UAE Labour Law. | Involves signing an independent contractor agreement. |

| Taxation | No personal income tax; no tax returns as per UAE regulations. | VAT (5%) for businesses with taxable income over AED 375,000. |

| Compensation | Monthly salary with allowances (housing, car) as per UAE Labour Law. | Fixed fees charged with invoicing. |

| Workers' Rights | Covered by labour rights including maximum working hours, overtime, and leave under UAE Labour Law. | Rights determined by the contract. |

| Termination | Eligible for severance pay based on employment duration as outlined in UAE Labour Law. | Responsible for own financial protection, including insurance. |

| Payment | Paid monthly through Wages Protection System mandated by UAE Labour Law. | Invoice clients upon task completion, standard 30-day terms. |

Employment Contracts

The United Arab Emirates (UAE) is a unique landscape when it comes to employment, accommodating both traditional employees and independent contractors. Understanding the legal framework governing employment contracts is essential for businesses operating in this dynamic region.

Legal Framework

- Employees: Employees in the UAE are regulated by the Federal Labour Law No. 8 (1980). This comprehensive law defines the employment standards and benefits that apply to all employees, ensuring their rights and obligations.

- Independent Contractors: Independent contractors, on the other hand, typically operate outside the scope of the Federal Labour Law, allowing for more flexibility and negotiation in their contractual arrangements.

Hiring Process

- Employees: Hiring employees in the UAE necessitates the establishment of a written employment contract, detailing critical elements such as the start date, end date, job description, workplace location, and the agreed-upon compensation.

- Independent Contractors: Independent contractors, however, engage through an independent contractor agreement. This contract specifies the scope of work, deadlines, and fees to be charged for their services.

Taxation

- Employees: Employees in the UAE benefit from the absence of personal income tax, eliminating the need for tax returns. Their income is typically taxed-free.

- Independent Contractors: Businesses with taxable income exceeding AED 375,000 are subject to Value Added Tax (VAT) at a rate of 5%. Independent contractors need to be aware of their VAT responsibilities.

Compensation

- Employees: Traditional employees often receive a monthly salary that may include additional allowances such as housing and car benefits, with the basic salary typically representing a significant portion of the total remuneration.

- Independent Contractors: Independent contractors work on a different compensation model. They charge fixed fees for their services and invoice clients upon task completion. Compensation is straightforward and devoid of allowances.

Workers’ Rights

- Employees: Employees are protected by the UAE’s labor rights, ensuring a maximum working day, overtime pay, and regulated leave entitlements. These rights are consistent with the provisions of the Federal Labour Law.

- Independent Contractors: Independent contractors’ rights are primarily determined by the terms of their individual contracts. Their working arrangements can vary significantly and are tailored to their specific agreements with clients.

Termination

- Employees: In cases of termination, employees are eligible for severance pay based on their duration of employment. The amount of severance pay is calculated according to established legal guidelines.

- Independent Contractors: Independent contractors must take responsibility for their financial protection, including insurance against illness or workplace accidents. They do not typically receive severance pay.

Payment

- Employees: Employees in the UAE receive their payments through the Wages Protection System, ensuring accurate and timely salary transfers.

- Independent Contractors: Independent contractors are paid upon task completion, following standard 30-day payment terms, as stipulated in their contracts.

Understanding the nuances of employment contracts in the UAE is crucial for companies seeking to engage with a diverse workforce that includes both traditional employees and independent contractors. It’s essential to navigate the legal framework, taxation, and rights to ensure compliance and maintain a harmonious working environment for all. In such times, an Employer of Record UAE is of utmost help to organizations to help them navigate in a foreign land.

Social Security in UAE

Social security is a crucial aspect of the employment landscape in the United Arab Emirates (UAE), ensuring the welfare and financial security of eligible individuals. Understanding the dynamics of social security is paramount for both employers and employees operating within this dynamic region.

- GPSSA (General Pension and Social Security Authority): GPSSA is responsible for administering social security insurance across the UAE, with the exception of Abu Dhabi. It plays a pivotal role in providing social security benefits to eligible individuals.

- ADRPBF (Abu Dhabi Retirement Pension and Benefits Fund): In the emirate of Abu Dhabi, ADRPBF manages the social security contributions for UAE nationals. The principles and obligations regarding social security within Abu Dhabi mirror those described for the rest of the UAE.

- GPSSA Pension Scheme: Eligibility for the GPSSA pension scheme is extended to UAE nationals with a family book and Gulf Cooperation Council (GCC) national employees. Those enrolled in this scheme are not entitled to receive an end-of-service gratuity. UAE nationals who do not meet the GPSSA registration criteria, along with expatriates in the UAE, are eligible to receive an end-of-service gratuity payment in accordance with the UAE Labor Law.

- Accumulated Contributions: UAE nationals aiming to receive GPSSA benefits must have accumulated at least 25 years of social insurance contributions. This criteria serves as a fundamental determinant for social security entitlement.

- GCC Employee Contributions: Employers in the UAE are responsible for mandatory subscriptions for their GCC employees, in adherence to the social security laws of the GCC employees’ respective home countries. The subscription share for GCC Nationals is aligned with the laws of their home nations, provided it does not exceed the share allocated for UAE Nationals by the employer. Any variance beyond this allocation is to be borne by the GCC employee. GPSSA subsequently disburses these contributions to the social insurance authorities of the GCC Nationals’ home countries.

- Contribution Rates: Social security contributions are an essential component of the system, ensuring the financial stability of the scheme. Employees contribute 5% of their salary, while employers’ contributions amount to 12.5%. These contributions are subject to a minimum salary floor of AED 1,000 and a maximum salary cap of AED 50,000.

Ensure your employees’ financial security and pension benefits in the UAE with Mercans. We handle all the details, ensuring that your social security contributions are promptly and accurately paid to the General Pension and Social Security Authority (GPSSA) in the UAE.

Payroll in UAE

Payroll requirements are governed by UAE Labor Law. There is no specific guidance for payslips, however, in general practice, they are released to employees monthly. Payments are controlled as per the Wage Protection System (WPS) for non-free zone companies. The employer will have to transfer salary payments via the WPS within two weeks of their due date, or on the dates specified in the work contract if such salary or wages are paid more frequently than monthly. It is mandatory to have a local employment contract and a salary transfer in UAE dirham.

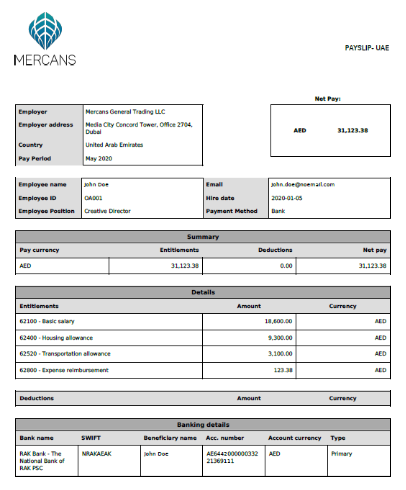

Sample Payslip

Mercans’ Payroll Capabilities

In the complex landscape of the UAE, where employer-employee relationships can be multifaceted, Mercans serves as your trusted Employer of Record (EOR) in the UAE for comprehensive payroll solutions. We understand that payroll is the lifeblood of your business operations, and our services are thoughtfully designed to meet your unique requirements.

Payroll Cycle in the UAE

Our end-to-end payroll services in the UAE, as your Employer of Record, cover the entire payroll cycle, ensuring precise and timely salary disbursements to both your employees and contractors. From gathering data to disbursing payments, we manage every step of the process, relieving you of the intricacies.

Local Currency Payments in the UAE

A key highlight of our payroll expertise as your Employer of Record in the UAE is the management of multi-currency payrolls. We guarantee that all payments are made in the local currency, aligning with UAE labor laws and regulations. This approach simplifies payroll distribution for your employees, eliminating the need for currency conversions.

Payroll Setup, Processing, and Administration with EOR in the UAE

Our proficient team as your Employer of Record in the UAE takes charge of the comprehensive payroll setup, processing, and administration. Whether you require support in establishing payroll systems, conducting routine payroll cycles, or administering various payroll components, we possess the knowledge and capabilities to ensure a smooth, error-free process.

Ensuring Statutory Compliance as your Employer Of Record in the UAE

Compliance is a central pillar of our payroll services as your Employer of Record in the UAE. We meticulously handle all statutory filings and payments, assuring that your business strictly adheres to local tax laws and regulations in the UAE. Our profound understanding of local compliance requisites guarantees that your organization maintains a favorable standing with the relevant authorities.

With Mercans as your Employer of Record in the UAE, you can concentrate on your core business activities, leaving the complexities of payroll management in our capable hands. Our deep expertise and experience ensure a payroll experience that is both seamless and compliant with UAE regulations, making us your trusted Employer of Record in the UAE.

UAE Employee Hiring Cost

Employing individuals in the UAE comes with various employer costs that encompass social security contributions, income tax withholding, and mandatory benefits. Let’s examine the employer costs for an employee with a Gross Annual Salary of AED 20,000:

Social Security Contributions

Employers in the UAE are obligated to contribute to social security programs. The annual employer cost for social security contributions for an employee with a Gross Annual Salary of AED 20,000 would be a factor to consider.

Total Annual Employer Costs

In addition to social security contributions, there may be additional expenses such as private pension contributions and various other potential benefits or allowances, which collectively contribute to the total annual cost of employing an individual with a Gross Annual Salary of AED 20,000.

| Gross annual salary | AED 20,000 |

|---|---|

| Total annual employer cost | AED 12.00 |

| Total annual cost | AED 20,012 |

Wage Protection System (WPS)

As of September 1, 2009, the UAE Ministry of Labor implemented a mandatory electronic salary transfer system known as the WPS (Wage Protection System). The WPS is obligatory for all employers registered with the Ministry of Labor in the UAE, with the exception of free zone companies. Employers are required to designate and formally engage an accredited agent licensed by the UAE Central Bank to facilitate the WPS. The employer provides instructions to its chosen bank for salary payments, with the bank serving as an accredited WPS agent.

The WPS agent electronically forwards the payroll details to the WPS, which, in turn, transmits this data to the Ministry.

The Ministry verifies the accuracy of the salary file in accordance with its records and communicates this verification to the WPS.

Subsequently, the WPS dispatches the salary file containing employee payroll particulars to the WPS agent along with authorization for payment.

The WPS agent carries out the disbursement of salaries to the employees, ensuring that payments are made in the local currency, the UAE dirham.

Mercans understands the significance of compliance with payroll regulations in the UAE, offering expert guidance to navigate the intricacies of the WPS and other labor-related processes.

Termination, Resignation or Retirement

In the United Arab Emirates (UAE), understanding the rules and processes surrounding termination, resignation, and retirement is crucial for both employers and employees. Here’s a comprehensive overview of these key aspects:

Probationary Period

Probationary periods are a common practice in the UAE, with a maximum duration of six months. Employers can terminate an employee’s contract without notice or end-of-service gratuity pay during or at the end of the probationary period. It’s important to note that this probationary period is included when calculating the employee’s total period of service.

Employment Contract Terms

Employment contracts in the UAE can be either for a fixed (limited) time or for an unlimited period.

- Fixed-Term Contracts: For companies onshore, fixed-term contracts cannot exceed two years, while in free zones, terms of up to three years are permitted. These contracts can be renewed by mutual agreement, and any extensions become part of the original term.

- Unlimited Term Contracts: These contracts have no set end date and can be terminated by either party for a “valid reason,” typically related to an employee’s performance or conduct. Notice must be given in writing as per the provisions of the UAE Labor Law.

Legitimate Causes for Dismissal (Employer) and Termination (Employee)

Under Article 120 of the UAE Labor Law, employers can legitimately terminate an employee’s contract without notice and end-of-service gratuity pay for several reasons, including submitting forged documents, probation period dismissal, causing substantial material loss to the employer, and more.

Employees also have grounds to terminate their employment contract without notice under Article 121, such as when the employer breaches their obligations or in cases of assault.

Disciplinary Procedures

The UAE Labor Law permits various disciplinary penalties, including warnings, suspensions, fines, and terminations. A specific procedure must be followed, which includes notifying the employee in writing of the charge, allowing them to defend themselves, conducting a thorough investigation, and imposing any penalties within set timeframes.

Redundancies

Redundancies are not officially recognized under the UAE Labor Law. Any termination for economic reasons must align with the existing termination provisions of the Labor Law.

Notice and Payment in Lieu

Notice periods are set by the UAE Labor Law. For unlimited contracts, the notice period ranges from 30 days to three months. If an employer does not require employees to work their notice period, they should provide payment in lieu of notice.

End-of-Service Gratuity

Employees who have completed at least one year of service are typically entitled to an end-of-service gratuity upon contract termination. The gratuity amount depends on the years of service and the type of contract. In the case of fixed-term contracts, employees may forfeit their gratuity if they resign before the term expires.

Understanding these facets of UAE labor regulations is essential for both employers and employees, ensuring that employment relationships are handled in accordance with the law and best practices. If you have specific questions or require expert guidance, consult with Mercans, your trusted partner in navigating the intricacies of labor laws in the UAE.

Employee Benefits in UAE

The United Arab Emirates (UAE) offers a wide range of benefits to its employees, both by law and as per contractual agreements. Here’s an in-depth look at the benefits granted to employees in the UAE:

- Annual Leave: Ranging from two days per month for those with more than six months and less than one year of service to 30 days per annum for those with over one year of service.

- Maternity Leave: Offering 60 days of leave, with 45 days at full pay and 15 days at half pay.

- Parental Leave: A five-day leave for new parents within six months of the child’s birth.

- Sick Leave: Granting 90 days of sick leave per annum, with different pay rates for various periods.

- Bereavement Leave: For mourning the death of close relatives, ranging from 3 to 5 days.

- Study Leave: A paid leave of 10 days for employees studying in certified institutions (after two years of employment).

- Sabbatical Leave: Provided for national service, in line with the state’s regulations.

At Mercans, we ensure employees receive all their benefits as per local labor laws, so you can focus on your core business activities. Let us take care of the intricate details of employment benefits and payroll management in the UAE. Contact us today to learn more.

Personal Income Tax

When it comes to personal income tax, the United Arab Emirates (UAE) stands as a shining example of a tax haven. This nation is renowned globally for its tax laws, which are notably few and remarkably straightforward. The UAE fosters a business-friendly environment by offering either full or partial exemptions from various taxes to both its residents and foreign citizens. Entrepreneurs working under UAE law in the nation’s free trade zones enjoy exemptions from taxes such as income tax, dividend tax, interest tax, and taxes related to import and export.

One key feature that adds to the allure of the UAE for entrepreneurs is its simplified business registration procedures, robust investment promotion policies, and the government’s commitment to substantial projects aimed at fostering the country’s sustainable development. These elements make the UAE an exceptionally welcoming destination for business ventures.

In this discussion, we delve into withholding tax, which is a tax commonly imposed in most countries, but is uniquely handled in the UAE.

Withholding Tax – A Non-Issue in the UAE

If you are conducting business within one of the UAE’s free trade zones, you are entirely exempt from withholding tax, as this tax has no application here. This exemption extends to all types of income—both corporate and personal—received within the UAE. In simple terms, there is no withholding tax to worry about.

The withholding tax in Dubai follows suit, adhering to the UAE’s tax laws. It is neither imposed on the local population nor on foreign citizens. In the UAE, withholding tax does not apply to interest, royalties, or income from real estate. Furthermore, the tax-free environment in the UAE ensures that there is no distinction between foreign citizens and UAE residents when it comes to taxes, including withholding tax.

In contrast to many other nations around the world, the UAE is earnestly committed to providing a propitious environment for businesses. The absence of various taxes, including withholding tax, serves as a testament to this commitment.

So, if you are contemplating where to launch or expand your business, the UAE should certainly feature in your considerations. The free trade zones, along with the exemption from various taxes, including withholding tax, and the UAE’s promising prospects for business growth, make it an ideal setting for giving your business a substantial head start when compared to similar enterprises in other parts of the world.

Personal Taxation – Virtually Non-Existent

For individuals employed in the UAE, there is currently no Federal or Emirate-level personal income tax in place. This means that individuals working in the UAE can enjoy the benefits of their earnings without the burden of personal income tax—a fact that further solidifies the UAE’s position as a tax haven.

Work Permit UAE

To reside and work in the United Arab Emirates (UAE), individuals are required to secure a residency visa through their sponsoring employer. The UAE government strictly adheres to these regulations, making it essential for foreign nationals seeking employment in the country to follow a specific set of procedures. Although these steps may vary based on the employee’s country of citizenship or their immigration status at the time of hire (for individuals recruited from within the UAE), the following provides a general overview of the process.

Residency Visa Process

Mercans’ Scope of Services

Mercans is your dedicated Employer of Record in the UAE, offering an extensive array of services to support your employment journey in the country. Our comprehensive scope of services covers all facets of your UAE employment process. From meticulously preparing your Ministry of Labor Offer Letter to managing the intricate work permit acquisition and entry permit procurement procedures, we provide expert guidance, ensuring a seamless entry into the UAE job market.

Rely on Mercans to streamline your residency visa application, overseeing all essential administrative tasks, including medical examinations and biometrics. We are well-versed in the complex landscape of UAE immigration and will make your transition to this vibrant nation effortless. By choosing Mercans as your Employer of Record, you are selecting a trusted partner dedicated to securing your successful employment in the UAE.

EOR Solutions in the United Arab Emirates (UAE)

Best Employer of Record UAE

Mercans Stands Out as the Leading Employer of Record in the UAE for the Following Reasons:

- Regulatory Compliance: Mercans ensures full compliance with all regulations set by MOHRE: Ministry of Human Resources & Emiratisation and relevant UAE authorities. It strictly adheres to the UAE’s employment laws and standards, guaranteeing full legal compliance.

- Independent Operation: Operating as a distinct entity, Mercans offers reliable and customised employment services tailored to the unique needs of businesses in the UAE.

- Diverse Employment Support: Mercans efficiently manages various forms of employment, including employees, freelancers, contractors, and expatriates, providing flexible solutions to meet a wide range of workforce needs.

- Enterprise-Focused Solutions: Specifically designed to cater to large enterprises, Mercans delivers scalable and sophisticated services that accommodate complex organisational structures.

- Multi-Currency Payroll Management: Mercans facilitates payroll processing in multiple currencies, ensuring seamless financial operations for businesses operating in the UAE and internationally.

- Global Reach and Payroll Expertise: With a robust international presence, Mercans excels in managing multi-country payroll, enabling smooth operations across borders.

- Data Protection and Compliance: Mercans adheres to rigorous data protection standards, including GDPR compliance and SOC 1 & SOC 2 certifications, ensuring the highest levels of data security.

- ISO Certifications: Mercans holds ISO 20000 and ISO 27001 certifications, reflecting its commitment to excellence in IT service management and information security.

- Security Standards Compliance: Mercans meets the OWASP ASVS 3.0 standards, ensuring strong security practices in application development and management.

- HR Blizz Platform: The proprietary HR Blizz platform is a global payroll and talent management SaaS suite that streamlines payroll processes while ensuring compliance with UAE regulations. With over 1,000 local experts, it provides in-depth knowledge of employment laws and business practices.

- G2N Nova Payroll Engine: G2N Nova offers global gross-to-net payroll processing across more than 100 countries, making it one of the most advanced payroll engines available. It can be deployed as a SaaS solution or integrated seamlessly with major Human Capital Management and Workforce Management systems.

Conclusion

In conclusion, Mercans offers a comprehensive suite of services to support your business in the UAE, whether it’s EOR solutions, recruitment, visa sponsorship, contractor payment management, transitioning freelancers into employees, or HCM integration. With our commitment to compliance and expertise, we’re your trusted partner for a successful venture into the dynamic UAE market. Choose Mercans to streamline your operations and ensure success.