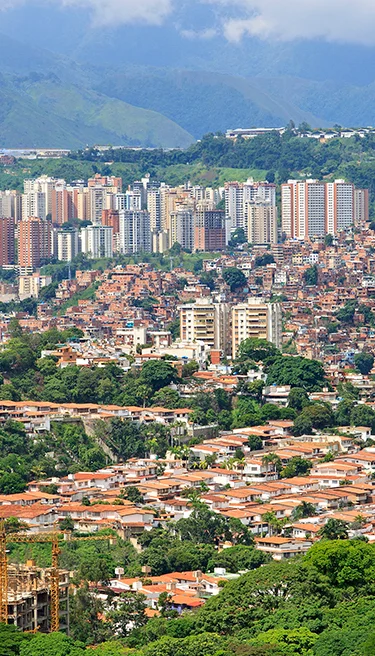

Mercans offers complete payroll, PEO and HR services in Venezuela

Venezuela has proven immense oil reserves and its natural resources include natural gas, iron ore, gold and other minerals. Despite these factors and the size of its national market, foreign direct investments have decreased in recent years due to the political and economic instability. There is significant disruption in Venezuela as a result of bad economic policies and political conflict and turmoil. As a result, there is food insecurity with communities struggling to access food, water, healthcare and other critical goods. There is also a large migration crisis unfolding.

Doing Business in Venezuela

Many ports and airports are being privatized which is great for foreign investment, alongside a young low-cost talent pool. However, the country is in the bottom percentile of the World Bank’s Doing Business Report. This does not bode well in light of the fact that Venezuela also has the highest inflation rate globally. Due to the current unstable political and economic situation, shortages of food, water and medicines as well as high levels of violent crime, travel is not recommended.

Entity Registration and Incorporation Requirements

Setting up a new business or expanding an existing one in Venezuela is straightforward. Choose how your company operates from a range of entity types that suit your individual circumstance.

Banking

Banking Hours: 8:00 am to 5:30 pm from Monday to Friday.

Working Week

The standard working week is from Monday to Friday from 7:00 am - 5:00 pm.

Labor Law

The New Organic Labour Law for Male and Female Employees (New OLL) applies to employment services, regardless of the employee’s nationality. It also applies to employment outside Venezuela if the contract was entered into in Venezuela unless the parties chose a different applicable law.

Main Industries

Petroleum, construction materials, food processing, iron ore mining, steel, aluminum

GDP Growth

-1.5%

Dates & Numbers

dd/mm/yyyy

Official State Name

Bolivarian Republic of Venezuela

Population

32.98 million

Capital

Caracas

Major Languages

Spanish

Currency

Venezuelan Bolívar (VEF)

Internet Domain

.ve

International Dialing Code

+58

Payroll

When an employer has 10 employees or more, the wages paid to foreign employees cannot exceed 20% of the total payroll. Employers are also given a limited period of time to incorporate outsourced employees into their payroll.

It is acceptable to provide employees with online payslips

Payslip

An employee is entitled to paid annual leave of 30 days

Annual Leave

An employee is entitled to paid sick leave for the first 3 days payable by the employer, with additional sick leave payable by social security.

Sick Leave

Employees are entitled to 26 weeks of paid maternity leave and 7 days of paid paternity leave, as applicable

Maternity & Paternity Leave

There is no statutory notice period applicable

Employee Termination

The 13th month payment is mandatory and generally paid out at the end of the year.

13th month salary

12600000 VEF per month

Minimum Wage

Overtime is calculated at 1.5x the employee's ordinary rate of pay

Overtime

Employers generally enter a severance agreement with their workers upon hiring.

Severance Pay

Tax and Social Security

Tax residents are taxed at progressive income tax rates while non-residents are taxed at a flat rate without any deductions. There are a number of required contributions such as social security, unemployment insurance, housing policy and towards training and education.

Tax

Performance or objectives-based bonuses that companies pay out to employees are not subject to income tax as they are considered non-recurrent and incidental earnings.

Corporate Income Tax

Personal Income Tax

Sales Tax

VAT

Social Security

Social security contributions are tax-deductible for the employer but not tax-exempt for employees. The state pension is funded by social security contributions.

Social Security Rate

Social Security Rate for Employers

Social Security Rate for Employees

Employment Law

There are no state grants or incentives applicable for employing people unless these are contractually agreed to between the parties.

Employment Agreement

A written employment agreement is not required except for fixed-term and fixed-work agreements and when Venezuelan nationals are hired to provide services abroad.

Working condition

Work hours are regulated based on whether the employee is taking on a day shift, night shift or mixed shift. Certain employees are exempted from these limitations such as management employees, inspection employees, guards and those for whom work schedules are established under collective agreement.

Leaves

All employees are entitled to 15 working days of paid vacation after one year of uninterrupted service. This is increased by one day for each subsequent year of uninterrupted service up to a maximum of 15 days.

Employment termination

There are no specific provisions relating to notice periods for termination of employment. However, employees are protected by labor stability, that is, they cannot be dismissed without justifiable cause.

Not required

Minimum notice period for terminating an employee

14 days

Total number of public holidays

40

Working hours per week

2 days

Total number of days for Compassionate & Bereavement Leave

Immigration

A foreign worker is required to obtain a work visa to begin working in the country. Where it is intended that the worker is hired on a temporary or indefinite basis, the non-resident employee visa is recommended (which is dependent on getting a work permit).

Residency permits

On approval of the work permit, the company must apply for the visa from the Administrative Service for Identification, Migration and Foreign Nationals or SAIME (Servicio Administrativo de Identificación, Migración y Extranjería). The work permit is valid for one year but may be extended.

Work Permit Validity

1 year

Required Documents

a valid passport

a completed application form

relevant and applicable government authorizations

proof of accommodation

confirmed job offer.

Build the best team and hire top talent compliantly in Venezuela. Get in touch with Venezuela payroll outsourcing & PEO specialists for a free consultation!